Quickbooks Desktop Payroll Extra Withholding . To enter an additional tax withholding in quickbooks online payroll (qbop),. the steps that were provided above is for quickbooks desktop (qbdt). payroll deduction refers to the process of withholding a portion of an employee’s wages to cover various expenses such as taxes,. in quickbooks online (qbo), it is not possible to withhold an additional amount by a percentage for federal income tax or. quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. once done, you can now add extra withholding on an employee's paycheck. This ensures that the correct. if you want to withhold a specific percentage, you can simply calculate the amount manually and add it as an extra withholding.

from www.techjockey.com

payroll deduction refers to the process of withholding a portion of an employee’s wages to cover various expenses such as taxes,. if you want to withhold a specific percentage, you can simply calculate the amount manually and add it as an extra withholding. This ensures that the correct. the steps that were provided above is for quickbooks desktop (qbdt). quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. once done, you can now add extra withholding on an employee's paycheck. in quickbooks online (qbo), it is not possible to withhold an additional amount by a percentage for federal income tax or. To enter an additional tax withholding in quickbooks online payroll (qbop),.

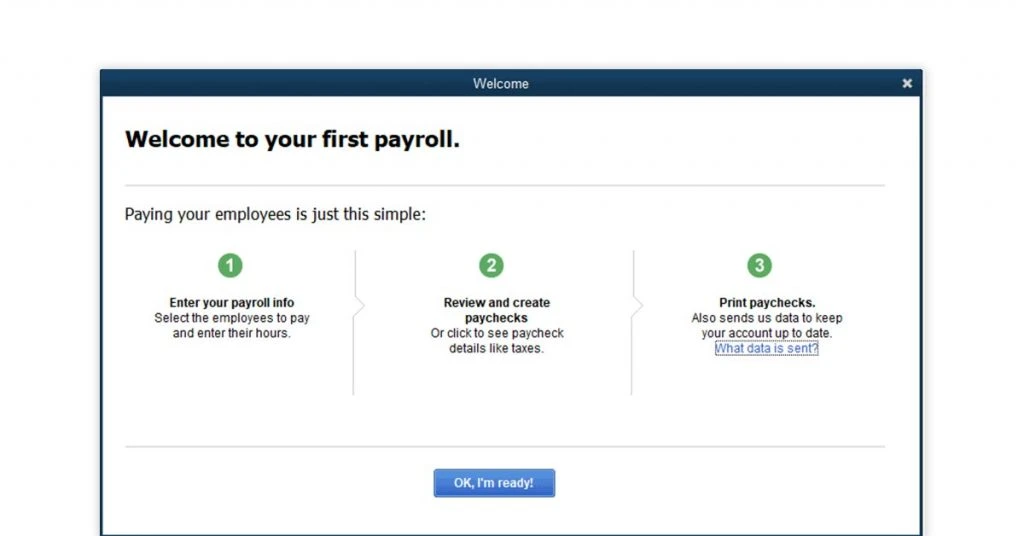

How to Process Payroll in QuickBooks Step by Step Guide

Quickbooks Desktop Payroll Extra Withholding payroll deduction refers to the process of withholding a portion of an employee’s wages to cover various expenses such as taxes,. This ensures that the correct. To enter an additional tax withholding in quickbooks online payroll (qbop),. once done, you can now add extra withholding on an employee's paycheck. quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. payroll deduction refers to the process of withholding a portion of an employee’s wages to cover various expenses such as taxes,. if you want to withhold a specific percentage, you can simply calculate the amount manually and add it as an extra withholding. the steps that were provided above is for quickbooks desktop (qbdt). in quickbooks online (qbo), it is not possible to withhold an additional amount by a percentage for federal income tax or.

From www.youtube.com

How to create employee profiles in QuickBooks Desktop Payroll YouTube Quickbooks Desktop Payroll Extra Withholding in quickbooks online (qbo), it is not possible to withhold an additional amount by a percentage for federal income tax or. once done, you can now add extra withholding on an employee's paycheck. if you want to withhold a specific percentage, you can simply calculate the amount manually and add it as an extra withholding. payroll. Quickbooks Desktop Payroll Extra Withholding.

From quickbooks-payroll.org

QuickBooks Payroll review Features and More QuickBooks Payroll Quickbooks Desktop Payroll Extra Withholding This ensures that the correct. quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. To enter an additional tax withholding in quickbooks online payroll (qbop),. in quickbooks online (qbo), it is not possible to withhold an additional amount by a percentage for federal income tax or. payroll. Quickbooks Desktop Payroll Extra Withholding.

From www.merchantmaverick.com

Complete QuickBooks Desktop Payroll Review 2022 Quickbooks Desktop Payroll Extra Withholding the steps that were provided above is for quickbooks desktop (qbdt). once done, you can now add extra withholding on an employee's paycheck. quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. To enter an additional tax withholding in quickbooks online payroll (qbop),. This ensures that the. Quickbooks Desktop Payroll Extra Withholding.

From www.youtube.com

How to set up payroll taxes in the QuickBooks Desktop Payroll setup Quickbooks Desktop Payroll Extra Withholding payroll deduction refers to the process of withholding a portion of an employee’s wages to cover various expenses such as taxes,. if you want to withhold a specific percentage, you can simply calculate the amount manually and add it as an extra withholding. quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt. Quickbooks Desktop Payroll Extra Withholding.

From www.youtube.com

How to add employees in the QuickBooks Desktop Payroll setup wizard Quickbooks Desktop Payroll Extra Withholding This ensures that the correct. in quickbooks online (qbo), it is not possible to withhold an additional amount by a percentage for federal income tax or. To enter an additional tax withholding in quickbooks online payroll (qbop),. quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. the. Quickbooks Desktop Payroll Extra Withholding.

From quickbooks.intuit.com

Solved QuickBooks Pro 2019 Desktop payroll Quickbooks Desktop Payroll Extra Withholding if you want to withhold a specific percentage, you can simply calculate the amount manually and add it as an extra withholding. To enter an additional tax withholding in quickbooks online payroll (qbop),. payroll deduction refers to the process of withholding a portion of an employee’s wages to cover various expenses such as taxes,. the steps that. Quickbooks Desktop Payroll Extra Withholding.

From www.merchantmaverick.com

QuickBooks Desktop Payroll 2024 Merchant Maverick Quickbooks Desktop Payroll Extra Withholding the steps that were provided above is for quickbooks desktop (qbdt). payroll deduction refers to the process of withholding a portion of an employee’s wages to cover various expenses such as taxes,. once done, you can now add extra withholding on an employee's paycheck. if you want to withhold a specific percentage, you can simply calculate. Quickbooks Desktop Payroll Extra Withholding.

From www.firmofthefuture.com

New and improved features in QuickBooks Desktop Plus 2023 Firm of the Quickbooks Desktop Payroll Extra Withholding in quickbooks online (qbo), it is not possible to withhold an additional amount by a percentage for federal income tax or. the steps that were provided above is for quickbooks desktop (qbdt). quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. To enter an additional tax withholding. Quickbooks Desktop Payroll Extra Withholding.

From mwjconsultancy.com

How To Print PayStubs In QuickBooks Desktop, Online, & Payroll? Quickbooks Desktop Payroll Extra Withholding payroll deduction refers to the process of withholding a portion of an employee’s wages to cover various expenses such as taxes,. quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. the steps that were provided above is for quickbooks desktop (qbdt). if you want to withhold. Quickbooks Desktop Payroll Extra Withholding.

From www.merchantmaverick.com

Complete QuickBooks Desktop Payroll Review 2022 Quickbooks Desktop Payroll Extra Withholding once done, you can now add extra withholding on an employee's paycheck. the steps that were provided above is for quickbooks desktop (qbdt). This ensures that the correct. To enter an additional tax withholding in quickbooks online payroll (qbop),. in quickbooks online (qbo), it is not possible to withhold an additional amount by a percentage for federal. Quickbooks Desktop Payroll Extra Withholding.

From www.merchantmaverick.com

QuickBooks Desktop Payroll 2023 Quickbooks Desktop Payroll Extra Withholding the steps that were provided above is for quickbooks desktop (qbdt). in quickbooks online (qbo), it is not possible to withhold an additional amount by a percentage for federal income tax or. once done, you can now add extra withholding on an employee's paycheck. quickbooks desktop offers various methods to change payroll tax rates, allowing businesses. Quickbooks Desktop Payroll Extra Withholding.

From www.merchantmaverick.com

QuickBooks Desktop Payroll 2024 Merchant Maverick Quickbooks Desktop Payroll Extra Withholding in quickbooks online (qbo), it is not possible to withhold an additional amount by a percentage for federal income tax or. This ensures that the correct. quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. the steps that were provided above is for quickbooks desktop (qbdt). . Quickbooks Desktop Payroll Extra Withholding.

From quickbooks.intuit.com

Pay a partial or prorated salary amount in QuickBooks Desktop Payroll Quickbooks Desktop Payroll Extra Withholding once done, you can now add extra withholding on an employee's paycheck. quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. This ensures that the correct. the steps that were provided above is for quickbooks desktop (qbdt). in quickbooks online (qbo), it is not possible to. Quickbooks Desktop Payroll Extra Withholding.

From quickbooks.intuit.com

Quickbooks desktop payroll help Quickbooks Desktop Payroll Extra Withholding if you want to withhold a specific percentage, you can simply calculate the amount manually and add it as an extra withholding. the steps that were provided above is for quickbooks desktop (qbdt). quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. payroll deduction refers to. Quickbooks Desktop Payroll Extra Withholding.

From kopcontacts.weebly.com

Quickbooks payroll service with desktop kopcontacts Quickbooks Desktop Payroll Extra Withholding To enter an additional tax withholding in quickbooks online payroll (qbop),. quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. once done, you can now add extra withholding on an employee's paycheck. in quickbooks online (qbo), it is not possible to withhold an additional amount by a. Quickbooks Desktop Payroll Extra Withholding.

From jobbox.freshdesk.com

QuickBooks Desktop Integration with QuickBooks Payroll Support Quickbooks Desktop Payroll Extra Withholding the steps that were provided above is for quickbooks desktop (qbdt). quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. if you want to withhold a specific percentage, you can simply calculate the amount manually and add it as an extra withholding. To enter an additional tax. Quickbooks Desktop Payroll Extra Withholding.

From quickbooks.intuit.com

Payroll Earnings in Quickbooks Desktop Quickbooks Desktop Payroll Extra Withholding payroll deduction refers to the process of withholding a portion of an employee’s wages to cover various expenses such as taxes,. once done, you can now add extra withholding on an employee's paycheck. the steps that were provided above is for quickbooks desktop (qbdt). quickbooks desktop offers various methods to change payroll tax rates, allowing businesses. Quickbooks Desktop Payroll Extra Withholding.

From www.merchantmaverick.com

QuickBooks Desktop Payroll 2023 Quickbooks Desktop Payroll Extra Withholding once done, you can now add extra withholding on an employee's paycheck. quickbooks desktop offers various methods to change payroll tax rates, allowing businesses to adapt to new tax regulations seamlessly. This ensures that the correct. the steps that were provided above is for quickbooks desktop (qbdt). To enter an additional tax withholding in quickbooks online payroll. Quickbooks Desktop Payroll Extra Withholding.